Top Equity Loans for Home Owners: Get the Best Prices

Top Equity Loans for Home Owners: Get the Best Prices

Blog Article

The Leading Reasons House Owners Choose to Protect an Equity Finance

For several house owners, choosing to protect an equity financing is a critical financial choice that can use different benefits. The capacity to take advantage of the equity integrated in one's home can offer a lifeline during times of economic requirement or work as a tool to achieve particular goals. From settling financial debt to carrying out significant home renovations, the reasons driving individuals to choose an equity car loan are varied and impactful. Recognizing these inspirations can shed light on the sensible economic planning that underpins such selections.

Financial Obligation Consolidation

Home owners typically go with safeguarding an equity loan as a tactical monetary move for financial obligation consolidation. By leveraging the equity in their homes, people can access a round figure of cash at a reduced rate of interest contrasted to various other forms of loaning. This funding can after that be used to repay high-interest financial obligations, such as charge card equilibriums or individual financings, enabling home owners to improve their monetary obligations into a single, much more workable month-to-month settlement.

Financial obligation combination through an equity loan can use a number of benefits to property owners. To start with, it simplifies the repayment process by combining several financial obligations into one, reducing the threat of missed out on payments and prospective charges. Second of all, the lower rate of interest related to equity financings can cause substantial expense savings in time. In addition, settling financial debt in this way can boost an individual's credit scores score by lowering their overall debt-to-income ratio.

Home Improvement Projects

Considering the enhanced value and performance that can be achieved via leveraging equity, numerous individuals choose to designate funds towards various home improvement jobs - Alpine Credits copyright. Property owners often pick to secure an equity loan particularly for refurbishing their homes because of the significant returns on financial investment that such jobs can bring. Whether it's updating outdated features, increasing home, or enhancing energy performance, home improvements can not only make living areas much more comfortable however additionally enhance the total value of the residential property

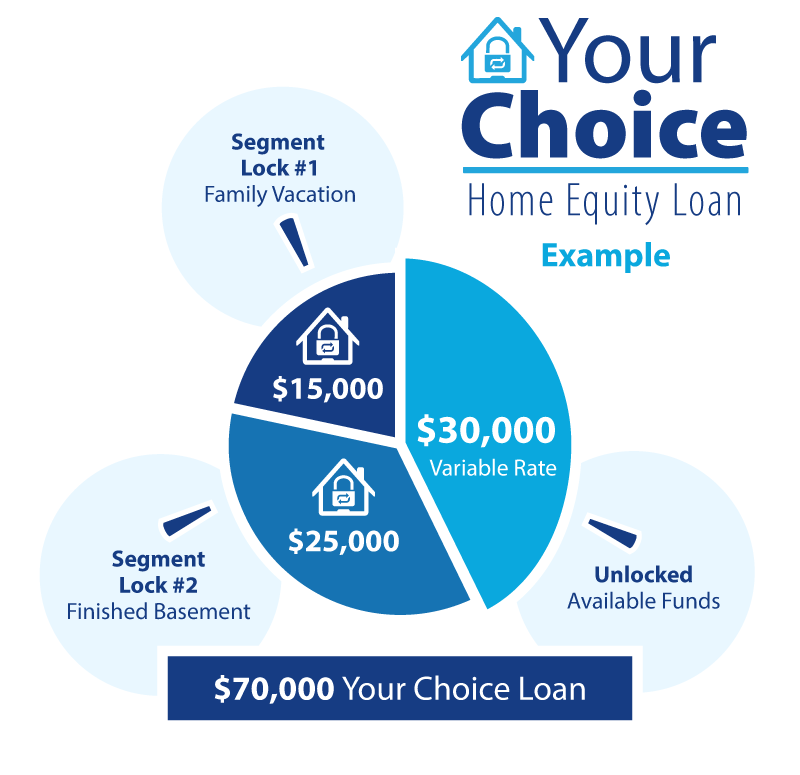

Common home improvement projects funded through equity car loans include kitchen area remodels, washroom renovations, basement finishing, and landscaping upgrades. These tasks not only enhance the lifestyle for homeowners yet also add to enhancing the curb charm and resale value of the residential or commercial property. Additionally, purchasing high-quality materials and contemporary design elements can even more elevate the aesthetic charm and performance of the home. By leveraging equity for home enhancement tasks, home owners can produce rooms that better suit their needs and choices while likewise making a sound monetary investment in their residential or commercial property.

Emergency Situation Expenditures

In unforeseen conditions where immediate monetary aid is called for, protecting an equity financing can supply homeowners with a sensible solution for covering emergency expenses. When unforeseen events such as clinical emergencies, immediate home repair services, or sudden task loss occur, having access to funds with an equity loan can supply a security internet for property owners. Unlike various other kinds of loaning, equity financings generally have reduced rates of interest and longer payment terms, making them a cost-efficient alternative for dealing with instant monetary demands.

Among the essential advantages of using an equity car loan for emergency costs is the rate at which funds can be accessed - Alpine Credits Home Equity Loans. Homeowners can swiftly use the equity accumulated in their property, permitting them to resolve pressing economic issues right away. In addition, the versatility of equity fundings enables home owners to obtain just what they require, staying clear of the worry of handling too much financial debt

Education Funding

In the middle of the search of higher education and learning, safeguarding an equity funding can act as a critical funds for property owners. Education and learning funding is a considerable concern for numerous households, and leveraging the equity in their homes can provide a means to gain access to necessary funds. Equity lendings frequently provide lower rate of interest prices compared to various other kinds of financing, making them an eye-catching choice for financing education and learning expenditures.

By using the equity accumulated in their homes, home owners can access considerable amounts of money to cover tuition fees, publications, accommodation, and various other associated costs. Home Equity Loan. This can be especially helpful for moms and dads wanting to sustain their children with college or people looking for to enhance their very own education and learning. Additionally, the rate of interest paid on equity financings click here to read may be tax-deductible, supplying possible monetary benefits for consumers

Eventually, making use of an equity car loan for education and learning financing can assist individuals buy their future earning capacity and occupation advancement while efficiently handling their economic obligations.

Investment Opportunities

Final Thought

Finally, house owners select to protect an equity financing for various factors such as debt loan consolidation, home improvement projects, emergency costs, education funding, and investment chances. These financings provide a method for home owners to access funds for vital economic demands and goals. By leveraging the equity in their homes, property owners can take advantage of reduced rate of interest and flexible settlement terms to achieve their monetary goals.

Report this page